Jan Borchert, Current Hydro and Dana Hall, Esq.

To finance the construction of the plant on behalf of the developer, there may or may not be a third-party investor or lender, who provides funding with a loan agreement to the developer. A Special Purpose Entity (SPE) with limited liability will likely be established, with the only asset it owns being the microhydro project.

Though usually not a concern for the offtaker, who is more interested in renewable energy, no up-front costs and a stable and predictable price of electricity for a long term, it can be useful to be aware of the relationships that the developer has with other parties in order to verify that the project has solid financial backing. The most common formats for the relationship between investor and developer are the sale-leaseback and the partnership flip.

Sale-Leaseback

In a sale-leaseback arrangement, the PPA developer sells the project to investors early on in the construction phase[1] for the purpose of exploiting the tax benefits associated with the project (see Figure Sale-Leaseback Stage 1). The investor provides the financial means to the developer, who uses the cash to construct the project and negotiate PPA terms with the power purchaser. Any party interested in this model must begin researching investors very early on in the process and discuss with them the specifics of the project, the expected returns and whether or not the project qualifies for tax credits.

In stage 2 of the Sale–Leaseback arrangement, once the project is operational, the developer enters into a PPA with a power purchaser to create the revenue stream for the project. A lease is established where the developer leases the project from the investor/owner (See Figure Sale-Leaseback Stage 2). The developer takes the payments received from the offtaker and uses them to pay rent to the investor under the terms of the lease. The developer will bear all the operating costs and must ensure that the project economics allow it to ensure a margin for profit. The developer receives 100% of cash flows after the lease term with the investor is fully paid (lease term and PPA term do not need to be the same duration of time). As lessee, the developer has a purchase option to buy the project. If the lessee doesn’t exercise the purchase option, control reverts back to investor.

Partnership-Flip

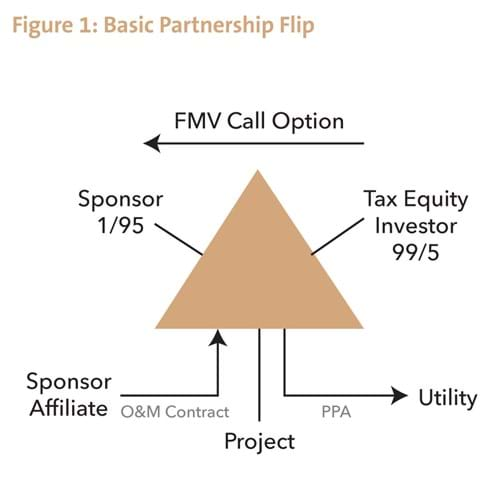

Partnership flips are a simple and flexible way to share tax and economic returns in a renewable energy project. For this structure (see figure below), the developer finds an investor who can use the tax benefits and the two own the project as partners through a partnership. In the typical partnership flip transaction, the partnership allocates 99% of income, loss and tax credits to the tax equity investor until a target yield is reached. After the yield is reached, the investor’s share of everything drops to a fractional percentage and the developer can buy the investor’s remaining interest.

Source: https://www.projectfinance.law/publications/2017/April/partnership-flips

There are multiple variations and forms of partnership flip transactions possible, but the goal is always to transfer tax benefits to a tax equity investor who can use them in exchange for project financing. See Norton Rose Fulbright blog for more information on this structure.

Next Steps

We’ve already mentioned that PPAs and PPA subcontracts can reach a high degree of complexity. But let’s look at the key legal provisions of the PPA structure… in our next post.

Or you download our full Microhydro PPA Report.

[1] To get the tax credits construction must have commenced. For solar and wind (which are the technologies that currently qualify) commencement can be demonstrated with either beginning physical work or incurring five percent or more of the total cost of the facility in the year that construction begins (safe harbor test).

No responses yet